Fortnightly Tax Table 2024 Pdf. Formula will be 5% * 2.5 lakh / 100. 10% tax calculation on income between 6 lakh to 9.

Using tax calculation formula in excel (provided above), you can calculate tax liability based on below steps: Formula will be 5% * 2.5 lakh / 100.

Rs 5,00,001 To Rs 10,00,000.

The above income tax slabs table is applicable for individuals below 60 years of age.

5% Tax Calculation On Income Between 2.5 To 5 Lakh In Old Regimes.

Rs 2,50,001 to rs 5,00,000.

Using Tax Calculation Formula In Excel (Provided Above), You Can Calculate Tax Liability Based On Below Steps:

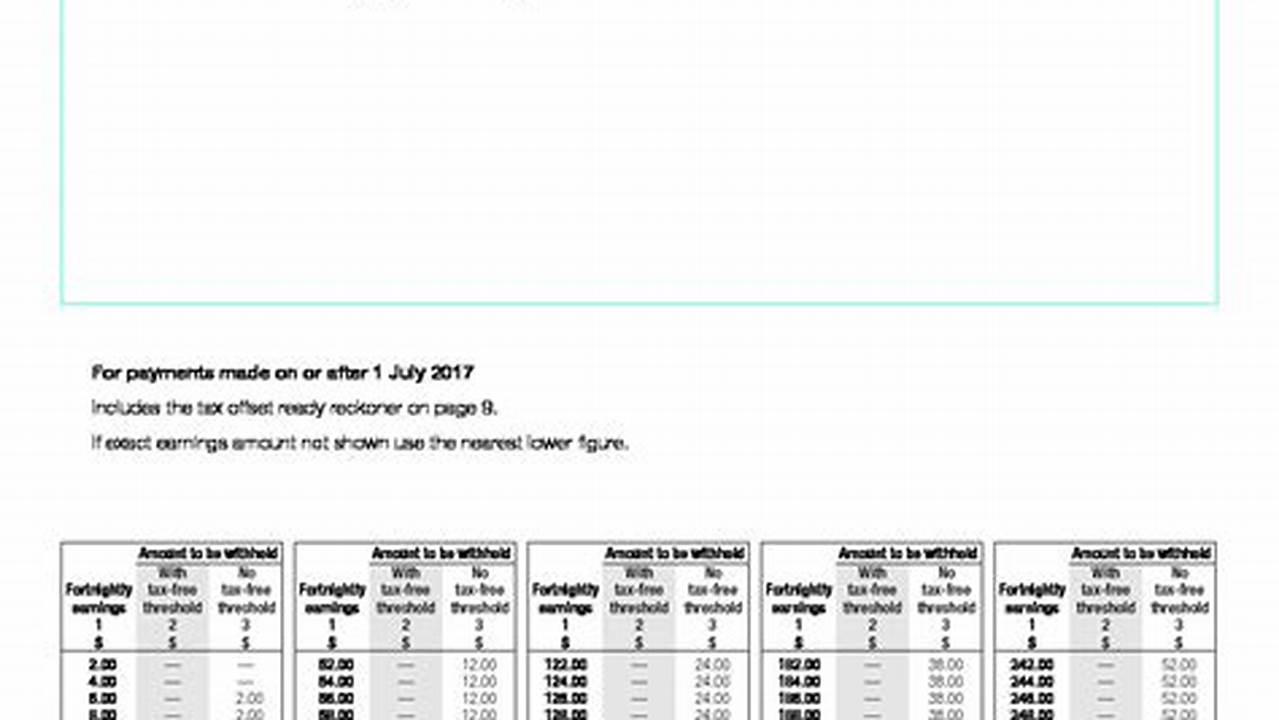

Images References :

Formula Will Be 5% * 2.5 Lakh / 100.

Cess at 4% will be levied on the income tax amount payable.

Using Tax Calculation Formula In Excel (Provided Above), You Can Calculate Tax Liability Based On Below Steps:

5% tax calculation on income between 2.5 to 5 lakh in old regimes.

Rs 2,50,001 To Rs 5,00,000.